Dr. A.P.J. Abdul Kalam University

Bachelor of Business Administration

First Semester Main Examination, Dec-2020

Basic Accounting [BBA104T]

Time: 3:00 Hrs Max Marks 80

Note: - Attempt any five questions.

All question carry equal marks.

Q.1 What is the meaning of Accounting? What are its branches? Explain briefly

limitations of Financial Accounting.

Q.2 Describe various conventions of accounting.

Q.3 Write out the following transactions in cash book with cash and bank

columns:

2020

Jan 1 Chandrika commences business with Rs.30,000 in cash.

Jan 2 He pays Rs.19,000 into bank account.

Jan 4 He received cheque for Rs.600 from Kirti and Co.

Jan 7 He pays Rattan and Co. by cheque Rs.330 and allowed

discount Rs.20.

Jan 10 He pays into bank Kirti and Co. cheque for Rs.600.

Jan 12 He receives cheque for Rs.450 from Warsi and allowed him

discount Rs.10

Jan 15 Tripathy and Co. pays into his bank account Rs.475.

Jan 20 He receives cash Rs.75 and cheque for Rs.100 for cash

sales.

Jan 25 He pays into bank Rs.1000.

Jan 27 He pays by cheque for cash purchase Rs.275.

Jan 30 He pays sundry expenses in cash Rs.50.

Jan 30 He pays John and Co. Rs.375 in cash and is allowed

discount Rs.25.

Jan 31 He pays office rent by cheque Rs.200.

Jan 31 He pays staff salaries by cheque Rs.300.

Jan 31 He draws a cheque for private use Rs.250.

Jan 31 He draw a cheque for office use for Rs.400.

Jan 31 He pays cash for stationery Rs.25.

Jan 31 He purchased goods for cash Rs.125.

Jan 31 He pays Jaspal by cheque for commission Rs.300.

Page [2]

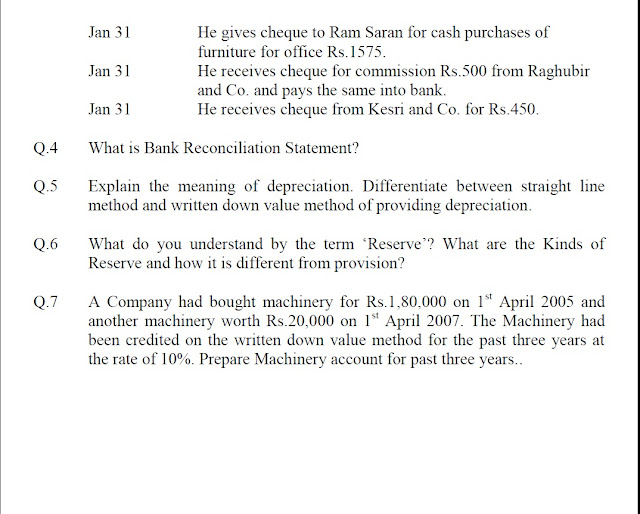

Jan 31 He gives cheque to Ram Saran for cash purchases of

furniture for office Rs.1575.

Jan 31 He receives cheque for commission Rs.500 from Raghubir

and Co. and pays the same into bank.

Jan 31 He receives cheque from Kesri and Co. for Rs.450.

Q.4 What is Bank Reconciliation Statement?

Q.5 Explain the meaning of depreciation. Differentiate between straight line

method and written down value method of providing depreciation.

Q.6 What do you understand by the term ‘Reserve’? What are the Kinds of

Reserve and how it is different from provision?

Q.7 A Company had bought machinery for Rs.1,80,000 on 1st April 2005 and

another machinery worth Rs.20,000 on 1st April 2007. The Machinery had

been credited on the written down value method for the past three years at

the rate of 10%. Prepare Machinery account for past three years.

Attachment in PDF: Please Click Here: Dr. A.P.J. Abdul Kalam University BBA I SEM Basic Accounting [BBA104T] Dec 2020 Question Paper

Scanned Copies:

0 comments:

Pen down your valuable important comments below