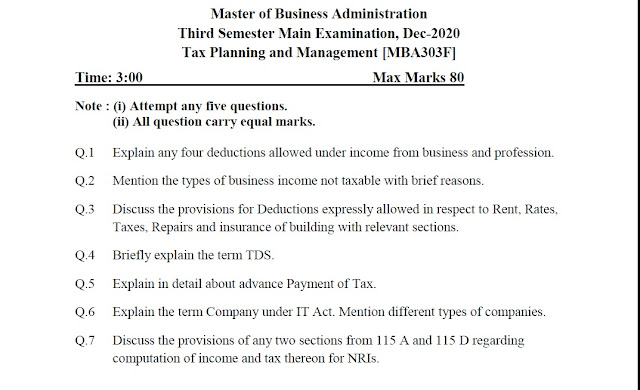

Dr. A.P.J. Abdul Kalam University

Master of Business Administration

Third Semester Main Examination, Dec-2020

Tax Planning and Management [MBA303F]

Time: 3:00 Max Marks 80

Note : (i) Attempt any five questions.

(ii) All question carry equal marks.

Q.1 Explain any four deductions allowed under income from business and profession.

Q.2 Mention the types of business income not taxable with brief reasons.

Q.3 Discuss the provisions for Deductions expressly allowed in respect to Rent, Rates,

Taxes, Repairs and insurance of building with relevant sections.

Q.4 Briefly explain the term TDS.

Q.5 Explain in detail about advance Payment of Tax.

Q.6 Explain the term Company under IT Act. Mention different types of companies.

Q.7 Discuss the provisions of any two sections from 115 A and 115 D regarding

computation of income and tax thereon for NRIs.

Scanned Copies:

0 comments:

Pen down your valuable important comments below